Should asset owners commit investment that reduces energy consumption when the returns will be shared between occupants and asset owners?

If you were to ask a home or business owner why they had invested in a renewable heating system (GSHP, ASHP, Solar Thermal) or Solar PV array they would tell you that the combination of payments from government (RHI or FiT payments) combined with the reduced energy costs made the return on investment attractive.

They’d be right because they benefit from both. Whilst reducing carbon emissions to tackle climate change is positioned as a moral imperative, for many it’s the financial benefits of lower energy costs that is a key motivator.

For asset owners, this realisation creates a significant dilemma. Should they commit investment that reduces energy consumption when the returns will be shared between occupants and asset owners? The short answer is “Yes” and for following reasons.

- Reducing energy consumption can lift households out of fuel poverty. The Annual Fuel Poverty Statistics in England, 2021 (2019 data) report published by the Department for Business, Energy and Industrial Strategy, 4th March 2021 [1], stated that there were an estimated 13.4% of households (3.18 million) in Fuel poverty in England. This was an improvement on 2018, where the number was reported to be 15% (3.52 million) so better but still wrong. The report found that a household’s fuel poverty status depends on the interaction of three key drivers:

- Energy efficiency – improvement in energy efficiency between 2018 and 2019 has brought more low-income households to band C which removes them from fuel poverty.

- Incomes – incomes increased at the median rate of increase for households near the low-income threshold so the share of households in relative poverty remained similar.

- Energy prices – between the 2018 and 2019 fuel poverty datasets energy prices rose by 3.2 per cent in real terms with higher increases for households on prepayment meters. Higher prices can bring a household’s income after fuel bills into poverty.

- Investment in energy efficiency can reduce the costs associated with energy use. To use a simple example, replacing a 60w bulb with a 4w LED bulb reduces the cost of lighting even though the frequency of use may remain the same. Reducing the total household energy cost also lessens the impact of energy price volatility. The in-pocket benefit of improving energy efficiency to low-income households can be significant.

- Targeted investment in energy efficiency can theoretically reduce spend on repairs and voids, servicing and inspections, and planned maintenance spend over a 30-year period. This creates the headroom necessary for the upfront investment. It is theoretically feasible to finance energy reduction investment within the typical £2,300 per unit per annum total that our benchmarking data indicates is typical across the sector. This does require asset management teams to rethink the way investment programmes are put together though, as this requires workstreams to be combined into a whole asset investment strategy.

- A large part of the reduction comes from replacing gas boilers with renewable energy alternatives. The risk associated with these heating systems is a lot less and therefore the repair or servicing periods can be extended. At the same time, investing in the fabric of the building paired with the installation of more efficient windows and doors can reduce repair demand and as well as reduce the costs associated with maintaining poorly insulated dwellings.

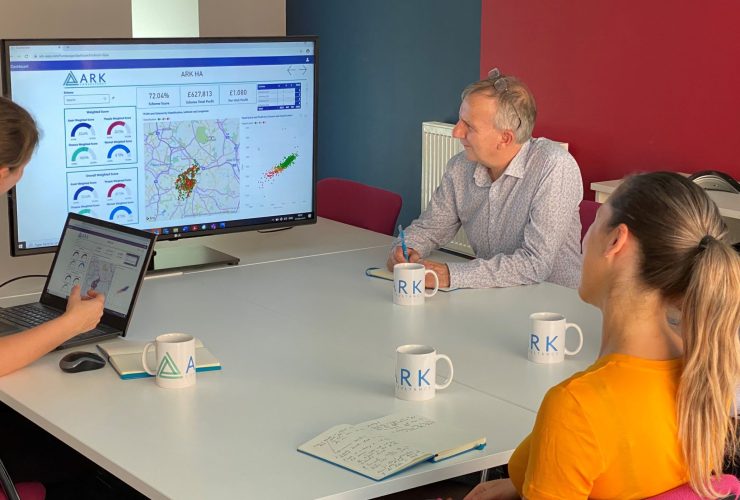

If an organisation understands how their stock is performing, then the results of this exercise will largely determine the investment priorities. For those organisations that do not know, or haven’t done this for a while, then we can help you. Our ASAP model, which does precisely this, as well as considering non-financial measures, is the best there is. Baselining asset performance is the first step in planning energy efficiency investment.

There seems to be a visible correlation between the average disposable income in an area and the vibrancy that exists. A common theme in all social housing business plans is community. The latest data on England’s rented portfolio indicates that the proportion of stock let and managed by social housing providers and local authorities accounts for approximately 18% of the total stock of 22.6m homes [2].

As a collective then, the affordable housing sector landlords are important stakeholders in what cities, towns and villages look like physically and how desirable they are as places to live. Any improvement in the level of disposable income available within households is therefore likely to have a wider community benefit although this is more difficult to predict, estimate and quantify. However, many social landlords expressly state their aim to improve the life chances of, or opportunities for, their customers. Putting more money in residents pockets is as good a place to start as any.

[1] Annual fuel poverty statistics report: 2021 – GOV.UK (www.gov.uk)

[2] Dwelling stock (including vacants) – GOV.UK (www.gov.uk)

For more information on how our ASAP model can help you understand your stock performance, get in touch with Adrian Redmond.

News & Insights

Read the latest housing sector news, blogs, and commentary from ARK.

Kirsty Wells to join the team as Assistant Director

By Helen Scurr ·We are excited to announce a senior figure in the social housing sector will be joining our consultancy team. Kirsty …

Building Safety

By Luke Beard ·The deadline for registering an existing higher risk building (HRB) with the regulator and submitting the required key building information …

Are you ready for the Supported Housing (Regulatory Oversight) Act 2023?

By Nick Sedgwick ·If you are a supported housing provider, you need to be aware of the new regulations that are about to …

Subscribe to our newsletters for the latest industry insights

Our newsletters and reports will keep you updated on topical issues from the sector as well as what’s happening at ARK.