Are you making smart asset management decisions?

Recent Regulatory Judgements and IDAs have reinforced the Regulator’s expectation for Landlords to understand the performance of their homes, in terms of energy efficiency, condition and financial viability.

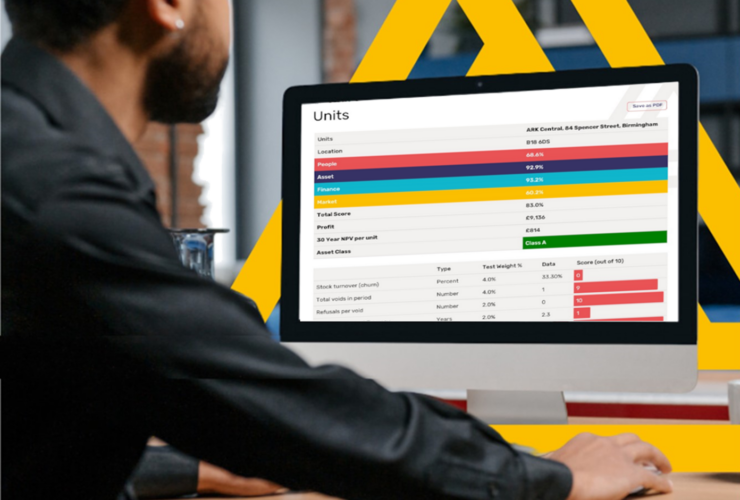

We understand this can be challenging and is why we have developed tools and expertise to help our clients with this task (find out more about our ASAP platform here). Not only can we help with your initial review, to identify poorly performing homes, but we can also rank them in order of performance and build you a database so that you can keep data and therefore rankings, up to date. This gives you control, on an on-going basis, to identify homes that require option appraisals to determine their future, to identify homes that require substantial works and those that fit well into your ongoing investment programmes.

A well-presented and evidence-based investment plan, that will maintain the quality of your homes, allows you to clearly communicate your plans to your customers and to the Regulator. The Regulator uses the Quality Standard to set out the condition and maintenance regime they expect, and it is therefore important your teams understand the requirements of this Standard. Spending time as a team reviewing the Standard, alongside your investment planning will quickly help you to identify areas of risk.

The majority of Landlords achieve the Quality Standard across their homes, but the focus on homes often results in external areas being pushed to the bottom of the priority list. The “quality of place” can be a disappointment for boards and executive teams when they visit estates and is a constant source of frustration for those living within these spaces. It is important that Landlords review both data and feedback from estate managers when setting their investment plans, to ensure external spaces are also maintained and improved. Poorly maintained external spaces attract vandalism and anti-social behaviour, creating a resource drain on management teams.

Landlords need to keep a ‘watching eye’ on homes identified for Option Appraisal reviews. Estates identified for regeneration are removed from investment programmes and this can create responsibility confusion or conflict for teams in the short term. Regeneration schemes can take years to move ahead as Landlords work through viability assessments, planning requirements and agree decanting programmes. Customers living in these areas can feel forgotten and their homes can deteriorate without regular maintenance. Indeed, homes identified for regeneration are often those that are suffering from mould and damp, and it is essential they do not fall off the radar.

The Decent Homes Standard (2015) contained the following:

“Registered providers may agree with the regulator a period of non-compliance with the … standard, where this is reasonable.”

Landlords need to ask themselves, where regeneration is identified, has the acceptance of short-term failure become the accepted modus operandi? Did they consult the Regulator about their plans and agree a timeline for non-compliance, did they set out how they would ensure health and safety matters are resolved, while homes are waiting for demolition? Regular two way-communication with customers is crucial so that issues can be identified early, and steps taken to improve the condition of homes in the short term.

Investment plans must also deal with evolving standards and the asset teams that develop these plans are under more pressure than ever. The priorities for investment can be absent, unclear, in conflict, or changing, investment planning is more iterative than it used to be.

The Government’s Sector Risk Profile report (October 2022) provided the following guidance:

“Boards must set a clear strategic direction and priorities for their organisations, and this is especially important when providers are facing an uncertain operating environment where many mitigation plans have already been deployed.”

“…boards must ensure they understand how the condition of stock relates to current and evolving requirements, in particular, from changing energy efficiency standards and the government’s decarbonisation and net zero agenda. Boards must also ensure that they understand the requirements of the Building Safety Act 2022 and the new regulatory regime being introduced by the Building Safety Regulator. Understanding performance against requirements requires a detailed knowledge of stock condition, and boards will need to ensure this is underpinned by accurate, up-to-date, and robust data.”

There should be a consensus on the priorities for investment which is communicated to teams within the organisation. These decisions on priorities should be made before Boards agree budgets, so they can provide the resources required.

We work with many organisations and Boards to support their strategic asset management and identify priorities for investment. If you would like to discuss how we can help you, simply get in touch with us.

News & Insights

Read the latest housing sector news, blogs, and commentary from ARK.

Kirsty Wells to join the team as Assistant Director

By Helen Scurr ·We are excited to announce a senior figure in the social housing sector will be joining our consultancy team. Kirsty …

Building Safety

By Luke Beard ·The deadline for registering an existing higher risk building (HRB) with the regulator and submitting the required key building information …

Are you ready for the Supported Housing (Regulatory Oversight) Act 2023?

By Nick Sedgwick ·If you are a supported housing provider, you need to be aware of the new regulations that are about to …

Subscribe to our newsletters for the latest industry insights

Our newsletters and reports will keep you updated on topical issues from the sector as well as what’s happening at ARK.